Justin S. Vaughn is an associate professor of political science in the School of Public Service and director of the Center of Idaho History and Politics at Boise State University. His research focuses on American politics, with an emphasis in executive politics, political rhetoric and communication, and the linkage between public policy and public opinion. He earned his Ph.D. at Texas A&M University, and his B.S. and M.S. at Illinois State University.

Among the big decisions the Idaho legislature and Governor C.L. “Butch” Otter must make this session is whether to reauthorize the “surplus eliminator” or allow it to sunset. Passed during the 2015 legislative session, the surplus eliminator is the wonky phrase that describes the law that was passed toward the end of that session that altered funding for transportation projects in Idaho.

Officially known as House Bill 312, the law did a few things. First, it increased vehicle registration fees and the state’s gas tax, the two primary ways that transportation projects are funded in Idaho. It also came up with a process to split equally the state’s surplus (i.e., extra unanticipated revenue that state brings in during the year) between two separate funds: the Budget Stabilization Fund and Strategic Initiatives Program.

The Budget Stabilization Fund, also known as the state’s rainy day account, had been largely depleted in the years following the Great Recession, and building it back up remained a priority for many state leaders. In fact, a 2013 version of the surplus eliminator program instructed the any state surplus beyond $20 million to go to that fund.

Note: Portions of this article have been adapted from the 2017 Idaho Public Policy Survey’s official report. You can read the full report here.

The addition of the Strategic Initiatives Program to the 2015 version is what made the 2015 law particularly noteworthy. This program required the Idaho Transportation Department (ITD) to develop a program where proposed projects from the state’s six transportation districts would compete for funding, with priority given to projects that enhanced safety, mobility, economic opportunity, repair and maintenance of bridges, and the purchase of public rights-of-way.

The result of this program was quickly realized; in December 2015 ITD announced it was funding 17 transportation projects across the state to the tune of $54 million dollars, which was provided by the surplus eliminator program. (This was on top of the $43 million spent on 27 other projects funded by the increased fees and taxes under the new law.) Already in the current session, the legislature has approved the transfer of another $11 million to ITD to fund seven bridge construction projects around the state.

The end result of the 2015 surplus eliminator program has been a significant increase in the state’s ability to fund necessary infrastructure repairs and improvements, while also continuing to increase the balance in the state’s rainy day account. In all, the program can be considered a great success, one neighboring states such as Washington are being pushed to adopt. However, the 2015 law only authorized the surplus eliminator program for two years, and absent steps taken to extend it, this funding mechanism for state transportation infrastructure will go away.

The state’s surplus is expected to be approximately $130 million dollars this year, making the conversation surrounding what to do with it particularly important and noteworthy. While simply reauthorizing the surplus eliminator is one option, doing so is not a foregone conclusion, as comments by legislative leaders during the AP Legislative Preview indicate. Senate President Pro-Tempore Brent Hill (R-Rexburg) mentioned education and tax relief as other possible funding targets, and Speaker of the House Scott Bedke (R-Oakley) identified three different schools of thought about what could be done regarding the surplus eliminator program: extend it into the future, put it entirely into the rainy day fund, or reduce taxes since the presence of a surplus itself could indicate rates are too high.

In light of the sizeable surplus and the expiration of the 2015 surplus eliminator program this year, we decided to dedicate part of the 2017 Idaho Public Policy Survey to investigating Idahoans’ attitudes about not just transportation funding, but bigger picture revenue and budget matters, too. What we learned told us a lot about how Idahoans feel about the state, its current fiscal situation, the condition of its transportation infrastructure, and what approaches to funding future infrastructure improvements are – and are not – popular with the public.

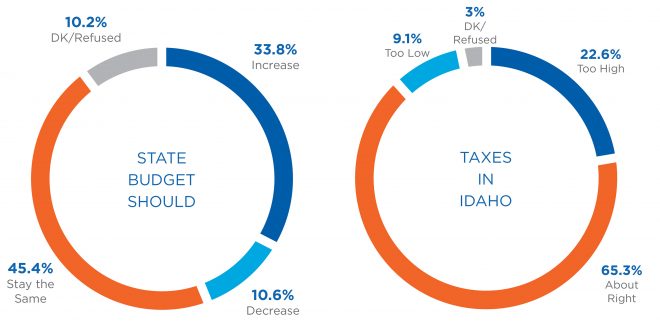

The results of the 2017 Idaho Public Policy Survey indicate that Idahoans are generally satisfied with the current fiscal activities of the state. 45.4% of respondents think the state’s budget should stay about the same, while about one-third (33.8%) of respondents think the state’s budget should be increased and only 10.6% think the budget should be decreased. These figures are consistent with last year’s. Similarly, almost two-thirds (65.3%) of Idahoans believe taxes in Idaho are about right, compared to 22.6% who say they are too high and only 9.1% who think they are too low. These figures are also almost identical to last year’s. Taken together, there is neither a significant push for a bigger state budget nor is there much demand for significant tax relief.

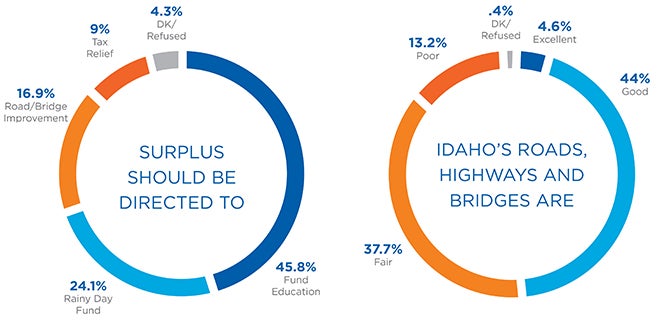

When asked about what should be done with the state’s expected $130M budget surplus, 45.8% think it should be used to fund public education, 24.1% think it should be deposited in the state’s rainy day savings account, 16.9% think it should be invested in road and bridge improvements in Idaho, and 9% think it should be used to provide tax relief. In other words, while the most common response is to dedicate funds toward education, perennially seen as the state’s most important issue, almost as many respondents supported dedicating the surplus to one of the two funds it currently goes to (e.g., the rainy day account or ITD’s strategic initiative). Moreover, tax relief was favored by fewer than one in ten Idahoans, an observation that is consistent with what we saw when a sizable majority suggested the current tax burden was either about right or too low (74.4% total).

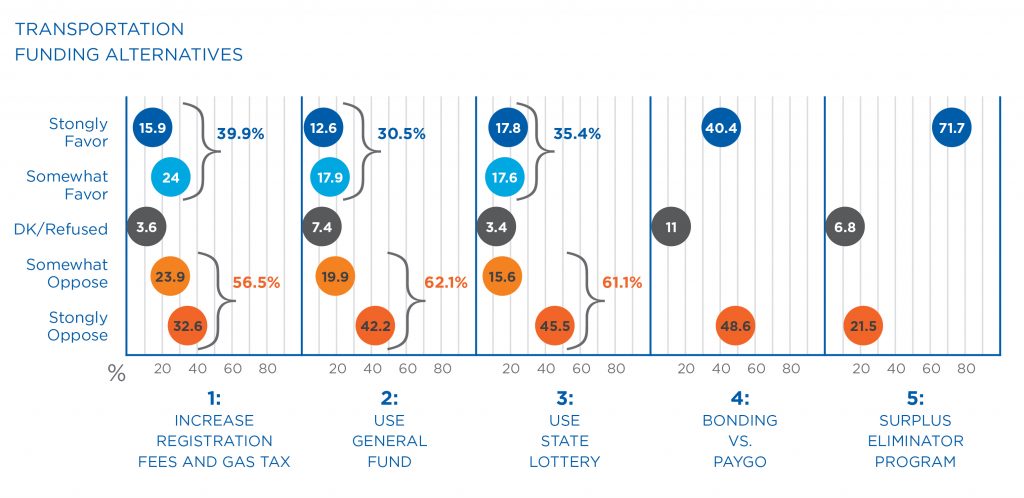

These figures are particularly meaningful when considering public attitudes about the state’s transportation infrastructure. Idahoans are generally fine with the current condition of the state’s roads, highways, and bridges, with 81.7% rating them as either good or fair, and only 13.2% rating them as poor. Perhaps because of this general satisfaction, most transportation funding solutions fail to achieve majority support. 56.4% of Idahoans oppose increasing registration fees and gas taxes to improve the state’s roads, highways, and bridges, while 62.1% oppose funding transportation projects through the state’s general fund and 61.1% oppose using Idaho state lottery money to fund those projects. Interestingly, Republicans are particularly opposed to raising registration fees and gas taxes while Democrats are particularly opposed to using either the general fund or state lottery. Overall, Idahoans are more open to funding transportation projects through bonding rather than the pay-as-you-go approach, with 48.6% supporting the use of bonding compared to 40.4% supporting the pay-as-you-go approach, which avoids taking on debt but is also more expensive. Democrats, more than any other group, favor bonding (61.6%).

The one transportation funding solution that achieves majority support is the reauthorization of the surplus eliminator program, which Idaho created on a temporary basis in 2015. Informed that this program splits surplus revenue between transportation funding and the state’s rainy day savings account, and that the program allows funding transportation projects without raising additional taxes or using the state’s general fund, 71.7% of survey respondents think the state legislature should reauthorize the surplus eliminator program, while 21.5% think the state should let it expire. Republicans, more than any other group, are particularly supportive of reauthorizing this program (78.3%). Considered alongside not only the lack of support for other conventional funding solutions but also public preferences about how the surplus should be spent – 41% support either depositing the surplus in the state’s rainy day account or investing in road and bridge improvements, even when funding public education is a stated alternative option – reauthorizing the surplus eliminator program is a decision that would clearly be met with support by the citizens of the state.

Thanks to tools such as the Idaho Public Policy Survey, legislators and other key decision makers in the state can access objective information about public priorities and preferences. In this case, with uncertainty about how the state’s large surplus should be spent, this survey provides evidence that there is not huge demand for additional tax relief and most approaches to transportation funding are not popular with most Idahoans. A sizable part of the state supports dedicating this year’s surplus to one of the two components of the current surplus eliminator program (e.g., either transportation or the rainy day fund) and a large percentage supports the state legislature taking action on reauthorizing the surplus eliminator. With evidence such as this, the situation seems much less murky; instead, reauthorizing the surplus eliminator and continuing the policy of splitting unanticipated revenues between the state’s rainy day account and ITD’s Strategic Initiatives Program seems an obvious solution.