Jeffrey Lyons is an assistant professor of political science in the School of Public Service at Boise State University. His research focuses on American politics, specifically public opinion, political behavior, political psychology, and state politics. He earned his Ph.D. and M.A. at the University of Colorado at Boulder, and his B.S. at the University of Idaho.

Justin S. Vaughn is an associate professor of political science in the School of Public Service and director of the Center of Idaho History and Politics at Boise State University. His research focuses on American politics, with an emphasis in executive politics, political rhetoric and communication, and the linkage between public policy and public opinion. He earned his Ph.D. at Texas A&M University, and his B.S. and M.S. at Illinois State University.

As the 2018 legislative session in Idaho proceeds, at least one thing is clear: tax reform is on the agenda for many lawmakers, lobbyists, and the state’s governor, C.L. “Butch” Otter. The governor has already signed into law a bill that cuts the unemployment insurance tax for employers, legislation that made its way through the lawmaking process in near-record time. His $200 million tax cut imitative has also been introduced, in the form of a bill that would package a $144.5 million reduction to individual income taxes with another $15.5 million cut to corporate income taxes and $42.3 million in support of a new child tax credit. The total cost of this package would be partially offset by nearly $100 million in revenue generated by the state conforming to national changes ushered in by the recent federal tax reform passed by the U.S. Congress and signed by President Donald Trump.

Notably missing among these forms of tax relief, however, is any reduction or elimination of the state’s tax on groceries. A dust-up over tax relief occurred at the end of the previous legislative session, when Governor Otter vetoed a bill that would have repealed the grocery tax. Intriguingly, that bill originally sought to reduce income taxes, before a Senate amendment “radiator capped” the language and turned it instead into a grocery tax bill. The controversy continued when the governor’s veto was later challenged, albeit unsuccessfully, in court by a group of legislators, shaping up a much-anticipated battle over which kind of tax relief Idahoans have in store.

A half-year after the judicial system ended grocery tax advocates’ crusade for reform, the table was set for the conflict to play out again, this time more directly, in the 2018 legislative session. As each side drafted their preferred legislation and prepared for another potential showdown, an essential question remained unanswered: what were the preferences of regular Idahoans? And, perhaps more importantly, what shaped those preferences?

ANALYZING IDAHOANS’ ATTITUDES ON TAXES

For three consecutive years, the School of Public Service at Boise State University has included questions about attitudes toward state taxation and spending on its annual Idaho Public Policy Survey. Across those surveys, attitudes toward the state’s fiscal picture have remained consistent – a plurality continues to believe the state’s budget should stay generally the same and nearly two-thirds think the state’s current tax burden is about right. This year, results show that two-thirds are also generally content with the state’s current tax system, thinking it either works fairly well as it is now or that only minor changes are necessary.

Overall, Idahoans seem basically satisfied with the status quo in this area; or, at least, there is no major demand for significant reform. That said, nearly half of the 2018 survey’s respondents said they would support lowering taxes in Idaho, even when reminded that doing so often means fewer resources available to pay for state and some local government services. So, even as Idahoans appear content with the state’s current approach to taxing and spending, there also seems to be at least some appetite for tax reduction. The question, then, is which type.

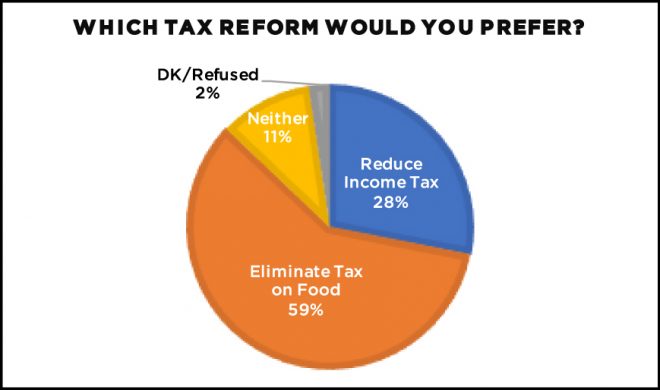

In order to try to understand not only what type of tax relief Idahoans prefer, but also why, we inserted an experiment in the 2018 Idaho Public Policy Survey conducted by the School of Public Service at Boise State University. Tax reform is a challenging issue to receive citizen feedback on due to the complexity of potential reform alternatives, the uncertainty surrounding the different likely effects of those alternatives, and nature of the tradeoffs that exist. To reflect this complexity, we broke our sample into three groups and randomly assigned them to receive different descriptions of the tax reform and the tradeoffs that could occur if a policy was adopted. Respondents in the first group (n=310), which we call our baseline since they do not receive any extra information, were simply asked if they had their choices of eliminating either the sales tax on food or reducing the income tax rate, which they would prefer. Respondents in this group expressed a decided preference for eliminating the sales tax on food (59%) compared to reducing the income tax (28%). Only a small percentage wanted neither (11%), or did not know (2%).

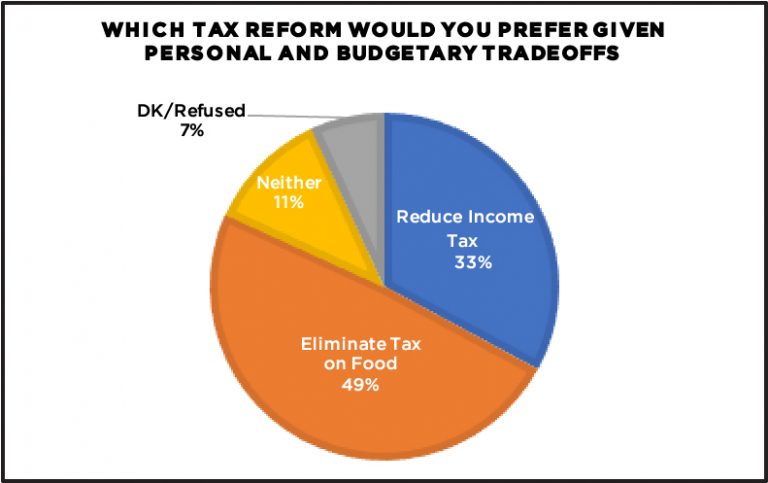

With this preference for the grocery tax in mind, we wanted to know how extra considerations and tradeoffs that are factors in this debate might alter citizen preferences. Specifically, we wanted to know how people would weigh information about the individual benefits of the cuts against the consequences for the state government’s budget. If the income tax is reduced, Idahoans will likely save substantially more money than they would by eliminating the grocery sales tax, but that also means that the state will have less revenue for services and might have to reduce them. We presented the second group of respondents (n=325) with this information and then asked them about their preferences for reducing the income tax or eliminating the sales tax on food. If we were to observe sizeable differences from the baseline question it would suggest that when presented with these considerations, citizens were adjusting their preferences. If we saw responses move in favor of the income tax it would mean that when citizens were informed about the magnitude of the tax savings for them, they shifted their preference despite the consequences for the state budget. This is the utility of the approach we have taken – rather than giving voters no information, or just a positive or negative piece of information, we are exposing them to the complexity of these kinds of policy choices and observing how the additional tradeoffs influence attitudes. The figure below shows Idahoans’ preferences for tax relief given the tradeoffs described above.

We see that preferences do shift, but not dramatically. There is a 10% reduction in the number of citizens who would eliminate the tax on food, but this option is still the most popular response with almost half of individuals selecting it. This is notable, as people are still opting for this form of tax relief even after being told it is not the one that will put the most money in their pockets. With that said, we do see a small increase in the percentage who prefer an income tax reduction (+5%), and an identical increase in the percentage who do not know which they would prefer (+5%). Although we are not able to say why so many citizens stick with a preference for eliminating the grocery tax – it could be either the effect of being told that state revenues would fall, or it could be a belief that necessities like food should not be taxed – we are able to say that when given more complete information involving the complex policy tradeoffs that follow tax reform, this more informed group still prefers to focus on the grocery tax, though less decidedly so than the group that was simply asked about its baseline preference.

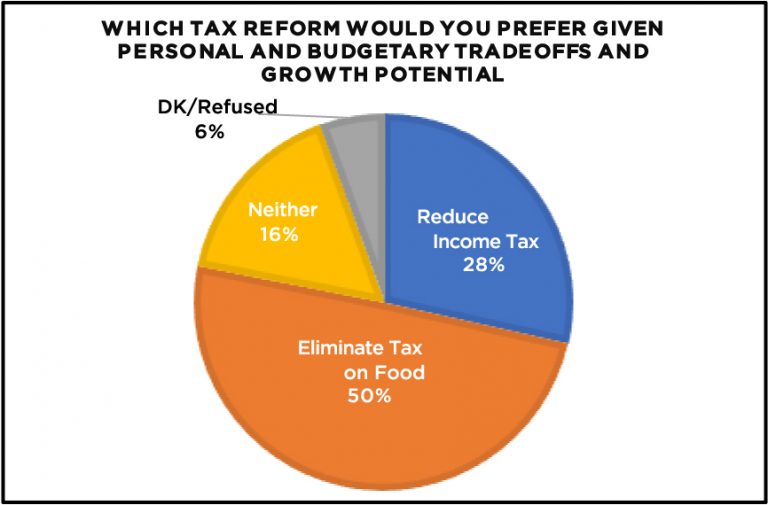

As a final test of citizen preferences, we added one more informational wrinkle – information about potential future impacts. The third group of respondents (n=365) was presented with the same information as the previous ones, but was also told that income tax cuts might make up for lost revenue with future economic growth, though this growth was not guaranteed. The preferences for this final group appear below:

A similar pattern emerges. Half of the respondents opted for eliminating the tax on food, essentially unchanged from the previous question-wording. Introducing the possibility of growth making up for lost state revenue in this version does not significantly alter support. If anything, this extra piece of information should make the income tax more appealing as we have not only told respondents that they will personally save more money, but also that there is a chance that state revenues will not suffer. The fact that we still observe such a consistent preference for the elimination of the grocery tax is striking, and suggestive of a consistent belief that, in principle, taxes on food are less desirable than income taxes. The other notable observation we have is that the percentage who respond that neither form of tax relief should be pursued has risen (+5%) in this version. We speculate that when exposed to the multiple layers of complexity and uncertainty on the matter, citizens may become ambivalent and opt for the status quo.

WHAT WE LEARN FROM UNPACKING COMPLEXITY

By including this experiment in the 2018 Idaho Public Policy Survey, we have been able to test what happens to opinions on tax reform as knowledge of the complex considerations becomes more complete. This is useful as citizen preferences on complicated policies are often not made with full information, which can result in survey responses that are not the best reflections of attitudes. In this case, we observed relatively consistent results across all of the informational considerations and policy tradeoffs that we presented, demonstrating a stable majority (or near majority) level of support for eliminating the sales tax on groceries.

The results tell us that grocery tax relief remains more popular than income tax relief, though the gap in support between the two alternatives varies in size. This suggests that how the issue is framed to citizens can make a difference, though perhaps not dramatically so. Our survey does not allow us to assess the extent to which such framing might matter, however. Nor does it tell us what is perhaps the most important thing in any policy choice – which alternative is empirically the best deal for the state and those who reside in it. After all, the Idaho Association of Commerce and Industry recently released an economic impact report, authored by two Boise State economists, that shows income tax reductions would significantly benefit all Idahoans, especially those in the lower-income brackets; another white paper the business advocacy organization put out shows how difficult it would be for low-income families to “break-even” if proposed grocery tax elimination took effect.

Determining which reform alternative to choose, if any, remains the responsibility of those who have been elected to represent their fellow Idahoans each day in both the state legislature and the governor’s office. The role public preferences play in determining policy outcomes has historically varied; the extent to which it will drive decision making on this matter in this legislative session remains to be seen.