Dr. Burkhart specializes in research on explanatory factors of cross-national democratization patterns, Canada-US borderlands and environmental policy, and political culture. He earned his Ph.D. from the University of Iowa and has been a visiting professor at the Norwegian Technical and National University in Trondheim, Norway. Dr. Burkhart’s book Turmoil in American Public Policy: Science, Democracy, and the Environment, was published by Praeger Press (2010). His research has also been published in several peer-reviewed journals, including American Political Science Review, American Review of Canadian Studies, European Journal of Political Research, Journal of Borderlands Studies, Journal of Politics, Social Science Journal, and Social Science Quarterly.

“It’s the economy, stupid.”

James Carville, sign in Clinton war room, 1992

The democracy tracking nongovernmental organization Freedom House, in its most recent global report, documents eleven countries who have suffered declines in democratic performance over the past two years, including Brazil, Hungary, Poland, Spain, and the United States. Common to each of these countries is their suffering substantial economic reversals during the past decade, one that began with the so-called “Great Recession”. Democratic collapses in countries around the world have also taken place during these recent rough economic times, such as in Mali and Turkey. These observations raise several questions. Do economic disasters beget political disasters? If so, then are the political collapses quick, or slow-moving? Are there any other factors that could influence political collapse? My research attempts to shine a light on the first two questions, positing a quasi-experimental design to test for temporal causality, both in the short-term and the long-term.

We should ask why this connection may exist. As a general sentiment, the economy means more to the public than simple accounting exercises, such as those that compile the total amount of goods and services produced in a quarter or a year. There is a psychological dimension to the economy, too, and on this front we place a great burden on the economy. For instance, consumer confidence is a well-known statistic to the public and its dips and upticks command the attention of business analysts as a harbinger of economic performance.

This particularly matters because the state of the economy can have political effects. For instance, national divides can be expressed in economic inequalities that generate populist resentment, and depending on the prevailing political mood can carry politicians who give voice to economic discontent onward to seemingly unlikely triumphs. On a different note, our societal expectations are that a smooth-running economy, with at least steady income growth to offset inflation, and expanding employment markets, will lead to favorable feelings about politicians, and thus favorable election results for them.

NATIONAL WEALTH AND DEMOCRACY

Political scientists set few “hard and fast” rules about political behavior. Several of those rules are in the realm of political economy, or the study of the connection between politics and economics. A rule that comes to mind is V.O. Key’s 1966 statement that the “standing decision” of American voters is party identification, and is the lens through which voters make their choice in the voting booth. Another is from Seymour Martin Lipset in 1959: “The more well-to-do the nation, the greater the chances that it will sustain democracy.” In making this claim, which speaks to the stock of wealth available in a polity, Lipset draws on one of the deepest veins of research in comparative politics stretching back to Aristotelian times.

According to the International Monetary Fund, over the past half-century the world has experienced four global recessions during the dataset period, in 1975, 1982, 1991, and 2009. These global economic disasters shook the political foundations of many countries. Upheaval in Greece, Iceland, Ireland, and Spain during the most recent recession, the Great Recession of 2009, remind us that political stability is hard-earned and subject to violent challenges. In the U.S., the rise of the Tea Party branch of the Republican Party and the Occupy Wall Street left-wing political movement were a direct result of the major bailouts put forward by the Obama Administration in support of “too big to fail” banks, Wall Street brokerages, and major corporations such as the Detroit auto industry. As each of these developments help attest, economic events have political consequences.

Social scientists have repeatedly confirmed the connection between stocks of wealth and democracy using extensive datasets covering lengthy time periods and measuring many countries. Evidence is not just anecdotal, however. Social scientists have repeatedly confirmed the connection between stocks of wealth and democracy using extensive datasets covering lengthy time periods and measuring many countries, pooling the data to create thousands of observations. The relationship is understood to be curvilinear, meaning that at a certain threshold of wealth stock, little if any more democracy can be purchased, so to speak.

The scholarship that addresses the flow of wealth, or economic growth, has less agreement on the ideal regime type for promoting growth, despite also gathering thousands of observations of countries and years. Cogent arguments, and compelling evidence, can be mustered for authoritarian, mixed, and democratic regime types primarily being the beneficiaries of economic growth, and potentially drivers of economic growth as well. There is an additional subset of literature that concludes that there is no effect at all on regime type from economic growth. I wish to address the question of whether or not global economic shocks have significant effects on global democratic performance.

ANALYZING THE SHOCK EFFECTS

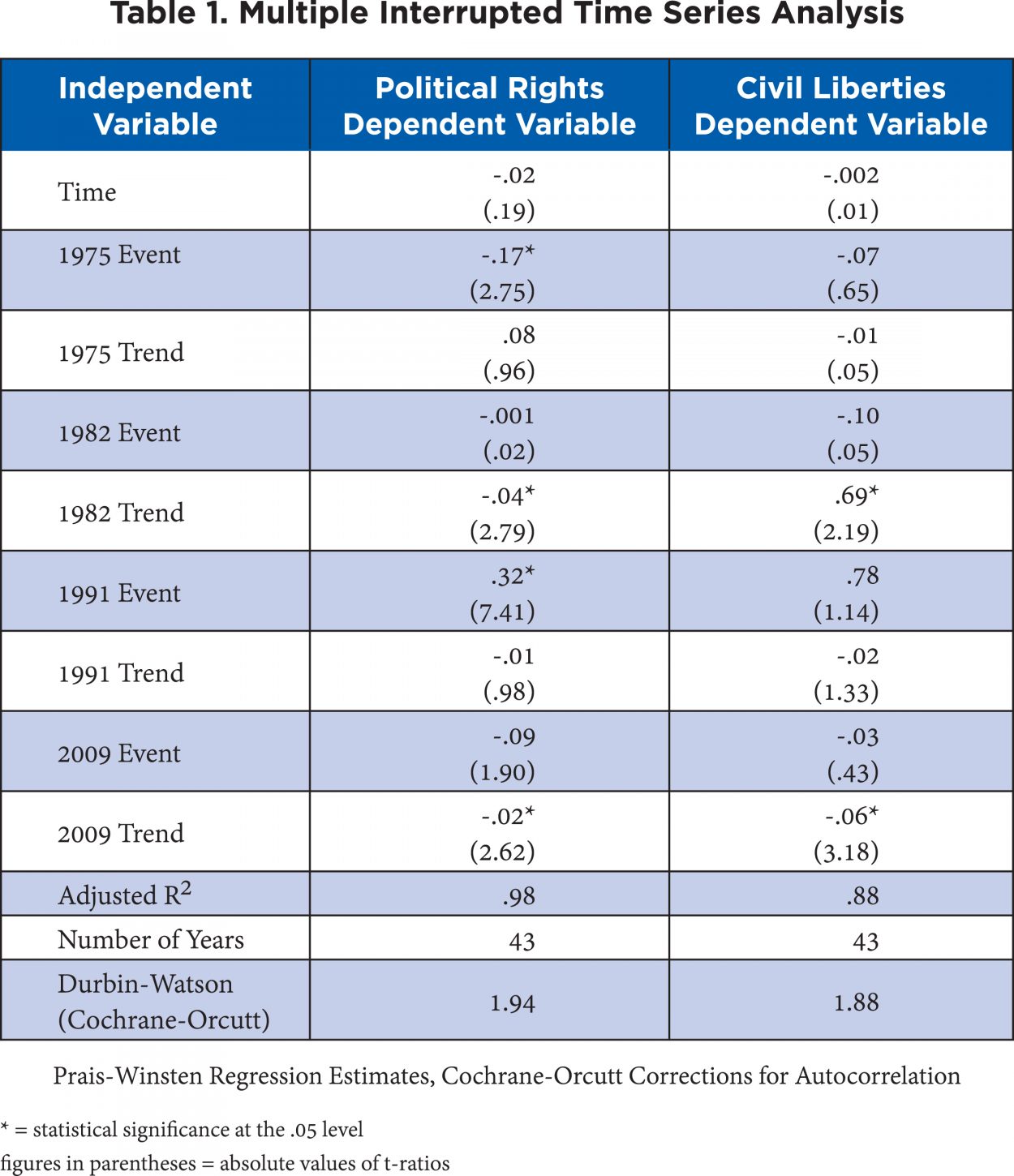

To answer this question, I collected data on the average annual global democracy score for each year during the 1972 – 2016 period, using the Freedom House “Freedom in the World” dataset of political rights and civil liberties. I then used the four previously mentioned recessions – in 1975, 1981, 1992, and 2009 – as the economic shocks themselves. To tease out the exact impact of these major economic events, I employed a statistical approach called multiple interrupted time series (MITS) analysis. The fundamental question for MITS is whether a particular event’s occurrence changes a variable’s behavior over time. The idea is to create a mathematical equation that accounts for the economic shocks to the system (the aforementioned four IMF-defined global recessions), and then measure the effect of those shocks on annual global democracy scores. This is accomplished through three sets of independent variables: a time counter variable measuring each year in the dataset, event variables that are scored 0 prior to each economic shock and 1 after each shock, and trend variables that are scored 0 prior to each economic shock and 1, 2, 3 and so forth for each year after each shock. The event variables measure the shorter-term effect of the shock and the trend variables measure the longer-term effect of the shock.

In interpreting the results of estimating the equations, we have the following ideas in mind. First, if the time counter variables are statistically significant, then that means that over time, democracy is either significantly trending downward or trending upward, depending on the sign of the estimated slope coefficient of the economic shock in question. If the event variables are statistically significant, then the economic shock themselves have either immediate negative or positive impacts on democracy. If the trend variables are significant, then the economic shocks, year by year, have a significant longer-term negative or positive effect on global democracy, again depending on the shocks under question.

In short, the results should indicate whether or not the global economic crisis had a permanent causal shift in the level and/or trend in global democracy. My hypotheses are that the short-term and long-term effects of economic shocks have negative effects on global measures of political rights and civil liberties.

The results of my analysis indicate that many of these economic shocks had either a short-term effect on global democracy or a long-term effect. The 1975 recession resulting from the OPEC oil crisis had a significant negative short-term effect on the political rights levels of global democracy. The 1982 recession that brought about record levels of unemployment and mortgage interest rates in the U.S. had a significant negative short-term effect on political rights, but a positive short-term effect on civil liberties, contrary to my hypothesis. The 1991 recession that raised unemployment rates dramatically also, peculiarly, had a positive short-term impact on political rights, but this can be partially explained by the collapse of the Soviet Union and Eastern European totalitarian governments during this time period. The 2009 Great Recession resulted in a negative long-term effect on both political rights and civil liberties (and just a smidgen away from statistical significance for short-term effects on political rights), providing evidence of the increased presence of illiberal regimes that commentators forecasted would occur more as disaffected peoples turn on their leaders. Thus, each economic shock had some demonstrable impact on global democracy.

CONCLUSION

These findings matter for two reasons. First, this is the first study to make use of MITS as a method to explain variation in global democracy via economic events. While MITS has limitations such as multicollinearity, a lack of other control variables, and a macro-level of analysis that will necessarily miss nuances in world regions and influential countries, it can provide some fundamental answers to the basic question of whether or not economic shocks affect political regimes.

Second, I have shown that the effects of economic disasters are both immediate and longer-term, and need to be recognized across the decades. We may celebrate economic recovery, or at least breathe a sigh of relief that the worst of the recession is passing. Yet each recovery, by definition, means that lost economic ground must be reclaimed for economic fortunes to progress. Couple that challenge with the significant short-term and long-term loss in global democratic performance as a result of multiple global economic shocks, we can then expect that the democratic gains from the post-Cold War era will be depleted, shock after inevitable shock. Those who care about democratic politics will need to display extra vigilance in chronicling these setbacks, and vigor in maintaining democratic institutions and processes.