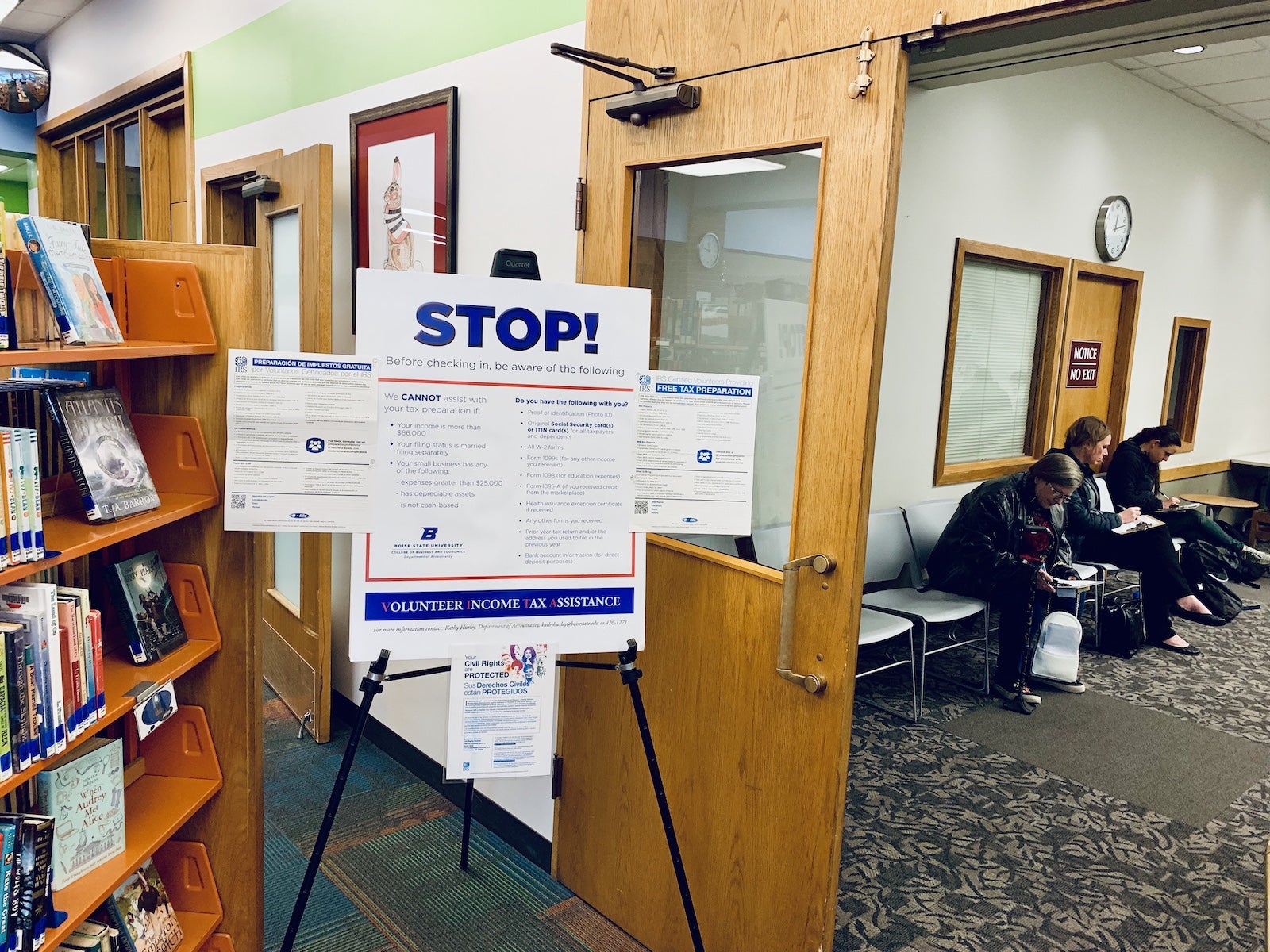

Accounting students in the College of Business and Economics are providing assistance to the community during what is a commonly stressful period of the year: tax season. The Department of Accountancy is offering a free tax preparation service – referred to as the Volunteer Income Tax Assistance program – for anyone who makes $66,000 or less annually.

The trained students will help clients prepare federal and state tax returns starting Feb. 5 at the Boise Public Library. They will be available from 12:30-4:30 p.m. (new returns must be started before 3:30 p.m.). Walk-in clients are assisted on a first-come, first-served basis; no appointment is necessary.

Spring 2020 dates:

- February 5, 12, 19, 26

- March 4, 11, 18

- April 1, 8, 15

What to bring:

- Prior year tax return

- Original social security card(s)

- Income forms (W-2s, 1099s)

- Other income or expense documentation

- Proof of identification

- Voided check (for direct deposit)

- Photo ID (if a return is prepared)

Please contact Kathy Hurley at kathyhurley@boisestate.edu for more information about this program. Please note: Hurley cannot answer specific personal tax and W-4 allowance questions on the phone or via email.