Guido Giuntini has been a lecturer in the Department of Economics at Boise State University since 2017. Before moving to Boise, he taught high school Economics in Pittsburgh, PA. He has a MS in Economics from the University of North Dakota. His main research interests are regional and social economics. Specifically, how activities impact local economies and how government policy can help prevent long term negative effects on children who suffer early trauma.

Steve Hall is a lecturer in the Department of Economics at Boise State University. He earned his Master of Science in Economics from Boise State University, following a BA in Quantitative Economics with a minor in Applied Mathematics. Steve’s focus areas include sustainability, localized economic growth, renewable energy, real estate markets, emergence in complex systems, machine learning, data science and engineering, and Python programming.

Steve has completed research projects involving distributed solar networks, real estate valuation, real estate taxation and is currently working on an urban land expansion growth accounting project. He is also the Energy Research Lead for the Idaho Climate-Economy Impact Assessment with the McClure Center for Public Policy at the University of Idaho.

Ready for a deep dive into the exciting world of property taxes?

The recent rapid increase in residential property taxes in the Treasure Valley and the rest of Idaho has seen growing debates and proposals on how to address the issue. The increase is due to a combination of mounting budget needs by local governments and rising property values.

What are property taxes?

As in many other states, property taxes are one of Idaho’s main ways to finance local governments. Specifically, about 50% of Ada County’s budget comes from property taxes. The budget covers services such as public safety, general government services, judicial services and sanitation.

The amount of residential property taxes in Ada County is based on the assessed value of the property. The taxable value is based on market value, minus a homeowner exemption up to $100,000 and targeted property tax relief known as circuit breakers. The tax levy, or tax rate, is calculated on budget needs and the total amount of taxable assessed value. It is worth noting that non owner-occupied properties do not benefit from homeowner exemptions.

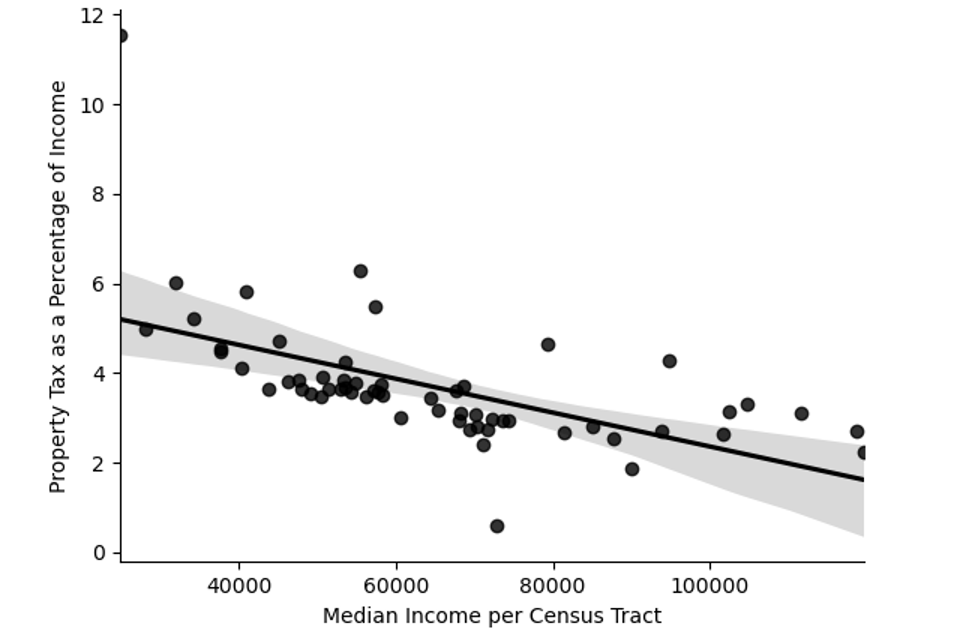

Like with sales taxes, property taxes are a fixed percentage (except when there is a homeowner exemption and circuit breakers). Sales taxes tend to be regressive on income. That means lower income households spend a higher percentage of their income on taxable goods and services, and they end up paying a higher percentage of their income in sales taxes.

Home values, household income, and property taxes

Can we say that property taxes in Ada county are regressive? That is, do lower income households pay a greater percentage of their incomes on property taxes? If lower income households live in proportionally lower value homes, then a property tax might not be regressive. Incomes and assessed values are not fixed over time. What happens when values rise sharply over a short period of time as is the case in Ada County?

Here is what the data tells us. Between 2012 and 2018, lower-value homes have appreciated faster than already higher-value homes. During that time period, the median home assessed value rose by 87%, and those in the top 20% of assessed value rose by 77%. But the value of homes that are in the lowest 20% of assessed value rose 143%. To put it another way, in 2018 the average assessed value for the top fifth was $594,420, while for the bottom fifth was $201,572.

The consequence is that property taxes increased proportionally more for lower-value homes. This is an effect of demand outpacing supply, as homeowners relocating from higher-value areas are able to pay more for homes in Boise and Ada County, and once less-desirable locations are now becoming in high demand.

At the same time, incomes of lower-earning households have remained stagnant, while higher earners have seen their incomes increase. In the same time period, the income of the bottom fifth of households did not change much, while the top 20% of earners saw an increase of the average household income of 20%. For comparison, in 2017 the bottom earners had an average income of $13,400, while the top earners had $202,200.

To put it another way, if lower income households live in lower-valued homes, while their home values have increased faster than average, they will be the most affected group.

Why do property taxes exist in the first place?

There are two opposite theories that explain the existence of property taxes. In one view, known as the “benefit view,” property taxes are payments that households make for the local services they consume. In the other, known as “capital-tax view,” property taxes are in essence a tax on the value of the house, referred to as capital.

The denser the area, the closer property taxes seem to align with the “benefit view.” Changes in the property tax structure have effects on the local housing market. In densely-built areas, the effect is mostly on price, while in rural, less dense areas, the effect is mostly on the housing stock. An aspect that stems from the “capital-view” theory is the possibility that increasing property taxes reduce the incentives of homeowners to make improvements on the house.

Landlords do not have the same incentive to improve properties as homeowners who live in the property. Either they can pass on the increase on property taxes directly to the tenant as increased rent, or they pass it on indirectly as lower quality housing. For example, in a study of rental market conditions in 115 municipalities in North Carolina, 60% of the tax increase was shifted toward the tenants.

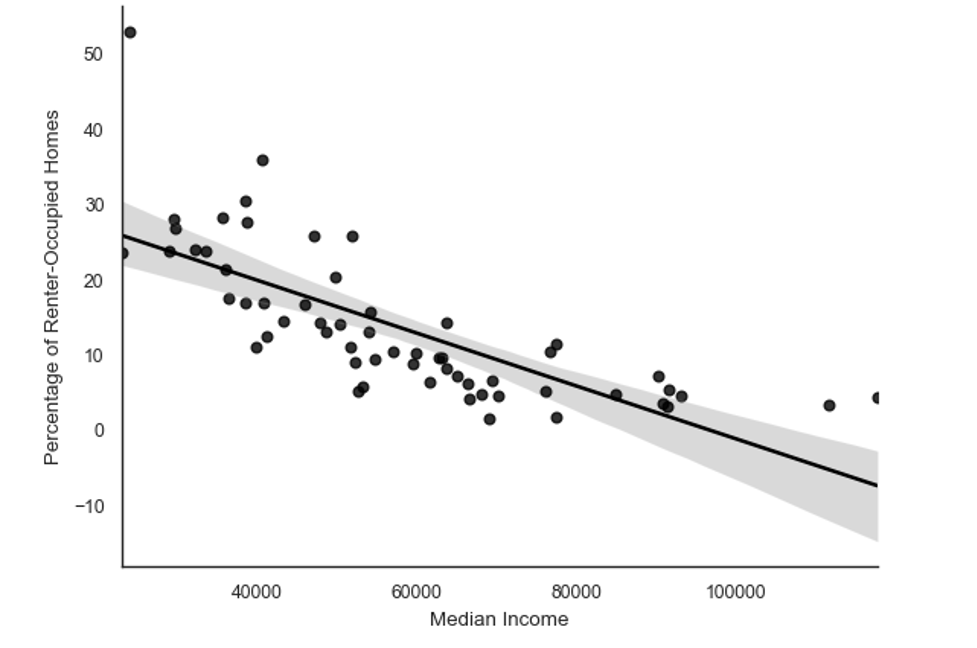

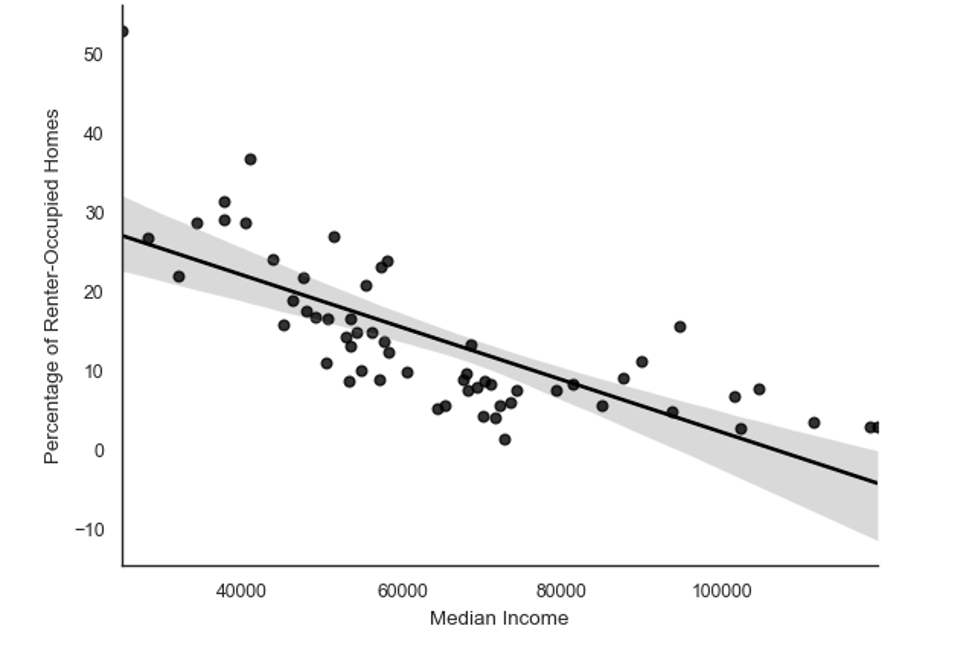

Our research considers the benefit view to be the relevant one since Ada County’s budget shows that property taxes directly pay for the services the county provides. In addition, Ada County is becoming denser. Surely, the presence of circuit breakers and homeowner exemptions can offer some assistance to low-income homeowners, but as we explain below, low-income families tend to rent more often than own. Renters do not benefit from homeowner exemptions.

Are property taxes in Ada County regressive?

Property taxes can be regressive on income depending on their structure and the local context. A nationwide study conducted by the Lincoln Institute of the Land Policy and Minnesota Center for Fiscal Excellence considers property taxes less regressive than sales taxes. It ascribes some progressivity to it given the presence of homeowner exemptions and circuit breakers. In our study, we find that the presence of the exemption actually disfavors lower-income households who rent, since the exemption applies only when the owner lives in the house.

When property values increase rapidly, like in the Treasure Valley in the last few years, do property taxes tend to become more or less regressive? After all, isn’t an increase of property value a good thing? Some researchers have maintained that property tax increases due to increased values simply incentivize homeowners to move to different communities with lower property taxes. Of course, this view does not take into account renters, who may be less mobile and less able to shoulder the social cost of mobility. This is true especially for elderly residents, who might benefit from local informal networks that they have created over the years and that would be hard to replicate.

For Ada county, individual household income data is not available. For this reason, we used census tract data. The Census Bureau divides the county in 59 census tracts. The segmentation is enough to allow a general analysis of household income trends. The analysis indicates that lower-income households live in lower assessed value census tracts. Lower-assessed value census tracts have a lower percentage of owner-occupied homes (more rental units). High rental areas have experienced the highest increase in property value, and the majority of renter-occupied properties have stayed as rentals during the same time period.

It is then possible to relate Ada County median household incomes and average property tax bills, accounting for homeowner exemptions, by census tract. The results demonstrate that property taxes were regressive in 2018, as lower income households paid more in property taxes than higher income households. Our finding has been confirmed by other research.

Is there a fairer way to tax property that does not punish lower income households?

A possible solution to correct for the increased regressivity is to implement a true progressive property tax system, similar to the Federal and State income tax structures.

Although the presence of homeowner exemptions and circuit breakers are already a form of progressivity, and several states have Mansion Taxes on high-value real estate transfers, progressive property tax proposals have not been successful in the United States. Our proposal introduces a level of flexibility that allows for easy realignments as conditions change. Value brackets and rates can be adjusted to fit specific policy needs. As impact fees rarely cover the cost of new construction, which tend to be of higher value than existing homes, this system will shift some of the cost from lower-value to higher-value homes. Bigger, more expensive homes, especially if surrounded by big yards, use more resources per capita in terms of energy, water, road maintenance, other services, and produce more carbon per capita.

As we have seen, the increases in assessed values experienced in the last few years in Ada County have disproportionately affected lower-income households. Renters bear the largest burden in terms of property tax as a percentage of income because, given the tight rental market, landlords pass on increases in property taxes to their tenants. Area residents with the lowest incomes are shouldering the highest relative tax burden.

Removing the existing homeowner’s tax exemption and implementing a universally applied progressive tax structure reduces the burden placed on renters and low-income households. A marginal tax structure also creates additional policy levers for local governments, which could allow for more consistent revenues.

A progressive tax system could have the short-term effect of increasing demand for existing smaller homes, with a short-term acceleration of their value. At the same time, it is likely to have the long-term effect of increasing the supply of smaller units and more dense, efficient development. The magnitude of the effects will depend on how developers, buyers, and homeowners react to the new system.

Implementing a marginal tax rate structure appears to be a fairer way to share the burden of the county’s recent development.

An app is available online to explore how different tax brackets and levy rates can be adjusted to achieve a set revenue goal for Ada County.

The data

Table 1: Differences in household income and property value, 2012 – 2019

Table 1 shows changes in household income and property values between 2012 and 2019 for Ada County. Some values are shown for different years, depending on availability.

Table 2: Property tax with progressive and old system

Table 2 shows a possible scenario for five homes of different assed values in Ada County. This scenario balances the burden of financing the county’s needs.

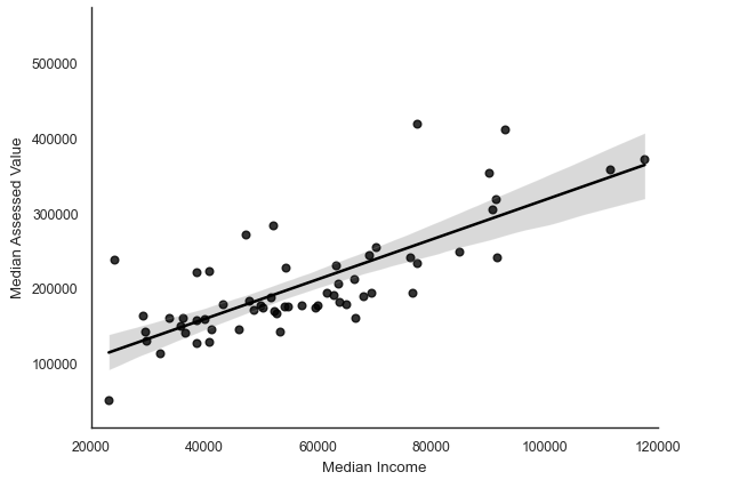

Figure 1: Relationship between income and home values by census tract, 2012

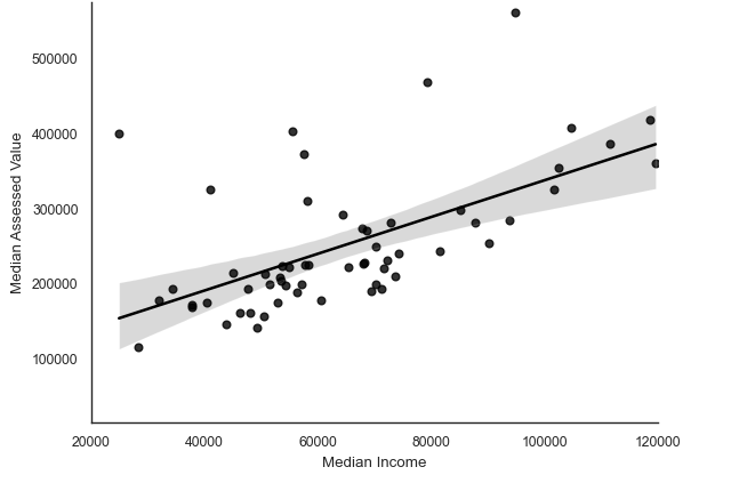

Figure 2: Relationship between income and home values by census tract, 2018

Figure 3: Percentage of renter occupied homes and median income by census tract, 2012

Figure 4: Percentage of renter occupied homes and median income by census tract, 2018

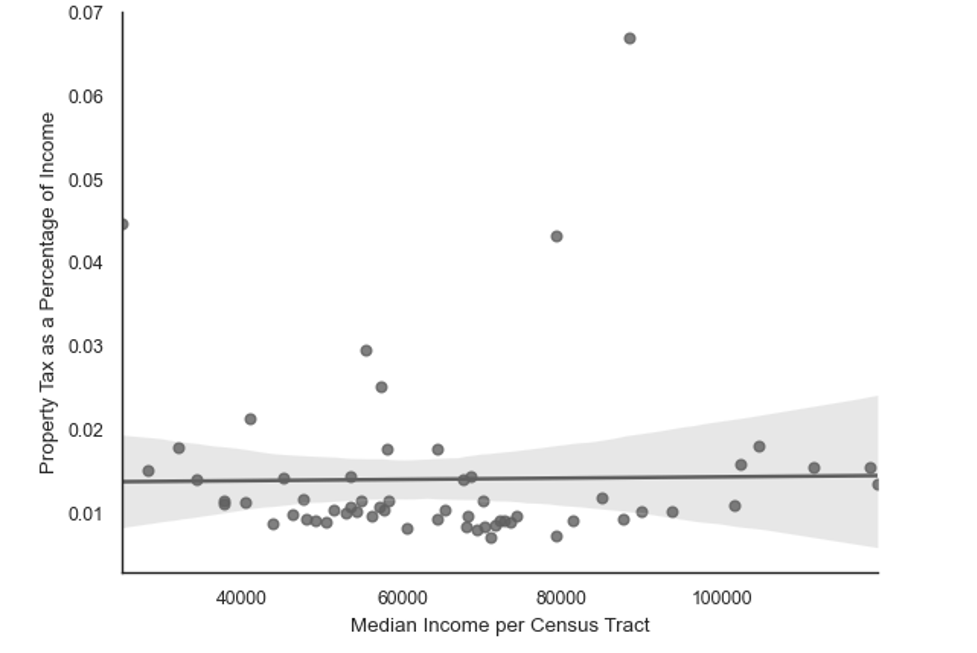

Figure 5: Property tax as percentage Income by census tract, 2018

Figure 6: Property tax as percentage Income by census tract with a progressive system as in table 2.