Ross E. Burkhart, Boise State University

Dr. Burkhart is Professor of Public Policy and Administration and PhD Program Director. He specializes in research on explanatory factors of cross-national democratization patterns, Canada-US borderlands and environmental policy, and political culture. He earned his Ph.D. from the University of Iowa and has been a visiting professor at the Norwegian Technical and National University in Trondheim, Norway. Dr. Burkhart’s book Turmoil in American Public Policy: Science, Democracy, and the Environment, was published by Praeger Press (2010). His research has also been published in several peer-reviewed journals, including American Political Science Review, American Review of Canadian Studies, European Journal of Political Research, Journal of Borderlands Studies, Journal of Politics, Social Science Journal, and Social Science Quarterly.

During the summer, a source close to the re-election campaign for President Trump stated this hypothesis: “Historical data says that with the economy roaring like it is, the incumbent always wins.” Is this hypothesis true? We should easily be able to test this hypothesis using appropriate measurements.

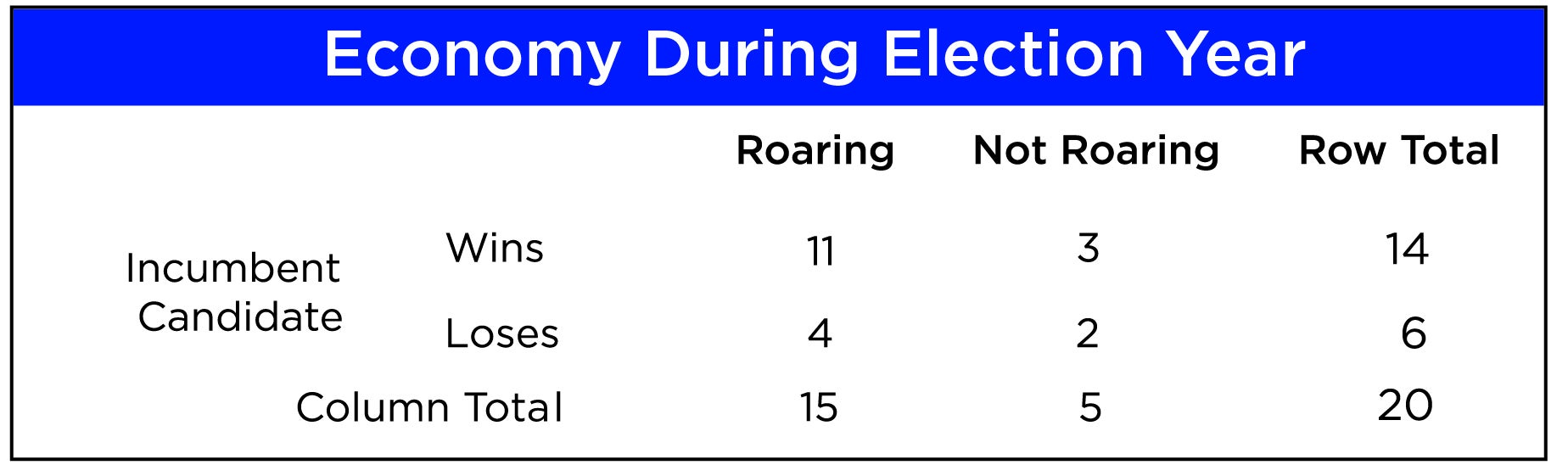

We have economic data from Yale University professor Ray Fair’s election forecasting project from the 1876 presidential election onward, in particular “G,” which is GDP growth over the first three quarters of the election year. Let us assume that “roaring” is positive GDP growth during those first three quarters, and “not roaring” is no GDP growth. Over the 20 presidential elections from 1876 – 2016 period when the incumbent was running for re-election, we can create a simple 2 x 2 table of economic growth and incumbent candidate electoral success:

On the face of it, the incumbent does not “always win” when the economy is experiencing growth. The four election years where the incumbent lost despite economic tailwinds were 1892, 1912, 1976, and 1992. (While the 1912 and 1992 elections involved viable third-party candidates, this fact proves the point that the economy is not the perpetually dominant factor in elections.)

The simplest formal test of the hypothesis is a Chi-square test, which tests whether or not the frequencies we observe in the four cells of the 2 x 2 table are different from frequencies we would expect if the cell frequencies were completely proportional to each other. A significant test result would indicate a statistically significant difference between actual and expected frequencies, in other words between incumbent success and the state of the economy. If the test is statistically significant, it then proves the hypothesis correct: economic growth unusually boosts incumbent victory likelihood, while no economic growth inevitably leads to defeat.

The Chi-square test statistic on the above 2 x 2 table is 1.38, smaller than the critical value of 3.841, leading us instead to accept the null hypothesis: economic growth does not significantly increase the likelihood of the incumbent presidential candidate winning re-election. Incumbents lose when the economy is doing well (four lost), and win when the economy is not doing well (three won), at a nearly equal rate, and for more than a third of the presidential elections in the dataset (seven out of 20).

We are led to the conclusion that there is clearly more to the presidential vote than economic determinism, though economics is a “heavy” or very important variable, in the parlance of Professor Michael Lewis-Beck in his book Economics and Elections. This should hold true in 2020, too.