Click Here to Schedule your Appointment Now

Boise State University, Micron Business and Economics Building (2360 W University Drive, Boise, ID 83706) will have a FSA (Facilitated Self Assistance) site in MBEB 2304. Please email Vitataxhelp@boisestate.edu to schedule an appointment.

Our Services

Free current, prior year or amended tax preparation within scope, including tax returns required for FAFSA. We do not prepare returns for those married, filing separately at any of our sites.

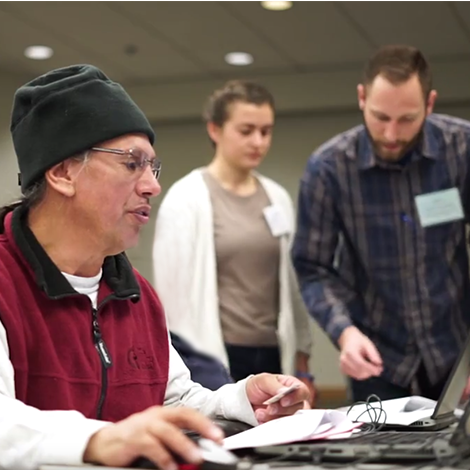

Our site has historically used one or two volunteers to assist one or two taxpayer at a time. “Facilitated Self Assistance (FSA) is our DIY tax preparation program. You can prepare your tax return (both federal and state) for free if your income is less than $84,000. You can also access in-person help (see our hours in MBEB 2304) or get questions answered via email (vitataxhelp@boisestate.edu).”

Tax payers that do not require assistance may file their own taxes for free with the IRS Direct File software – Click here to access the IRS Direct File Software to prepare your taxes from home.

Required Items

Please have these items available so that we can prepare your return:

- VITA Intake Form – Please complete this form and bring it with you to your appointment.

- Photo ID

- Social Security card(s)

- Income Forms (W-2s, 1099s)

- Documentation for other income and/or expense

- Bank account information (voided check) for direct deposit

- Prior year tax return

Where’s My Federal Refund?

Here is a video tax tip from the IRS:

Where’s My Refund? English | Spanish | ASL | Chinese | Vietnamese

Subscribe today: The IRS YouTube channels provide short, informative videos on various tax related topics in English, Spanish and ASL.

- www.youtube.com/irsvideos

- www.youtube.com/irsvideosmultilingua

- www.youtube.com/irsvideosASL

- www.youtube.com/irsDirectFile

Where’s my Idaho State Refund

- Idaho State Tax Commission Refund Info

- Click on the “refund status page” link

Other Resources

- Get an IRS Identity Protection (IP) PIN: https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin

- AARP is operating Tax-Aid sites with tax document scanning and remote tax return preparation. Appointments with AARP can be found at www.aarp.org/money/taxes/aarp_taxaide/locations.html

- Visit the IRS free file website for self help.

- You can also find out about free filing software on the IRS website.

- If you need to file an extension, please watch this IRS video.

- More information about VITA.

Email Us

Please email VITAtaxhelp@boisestate.edu if you have difficulty scheduling your appointment.

Please add VITAtaxhelp@boisestate.edu to your contact list.

VITA Partners

- Internal Revenue Service

- International Rescue Committee (IRC)

- Boise Community Schools

- Boise Public Library

- University of Idaho Law School

Interested in becoming a VITA volunteer?

For more information about becoming a VITA volunteer please review the IRS VITA Volunteer information, or email VITAtaxhelp@boisestate.edu.