The Sponsored Project Budget v. Actuals Report (BvA) is designed to be the most accurate source of financial information for your sponsored projects, including forward-looking salary and fringe benefits encumbrances that have been submitted to HR and entered into the Oracle Human Capital Management (HCM) application. You are strongly encouraged to use this BvA instead of Bronco Hub’s Account Analysis Report (AAR) or Manage Awards (PPM).* Please read the Frequently Asked Questions (FAQ) below for more information about the BvA, including how often the data are refreshed and how to customize your settings to represent the data you desire to see by default.

*Bronco Hub’s “Manage Awards” area is based on data from Oracle Financials Cloud’s (OFC) Project Portfolio Management (PPM) subledger. It is commonly known as PPM.

Frequently Asked Questions

How do I access the BvA?

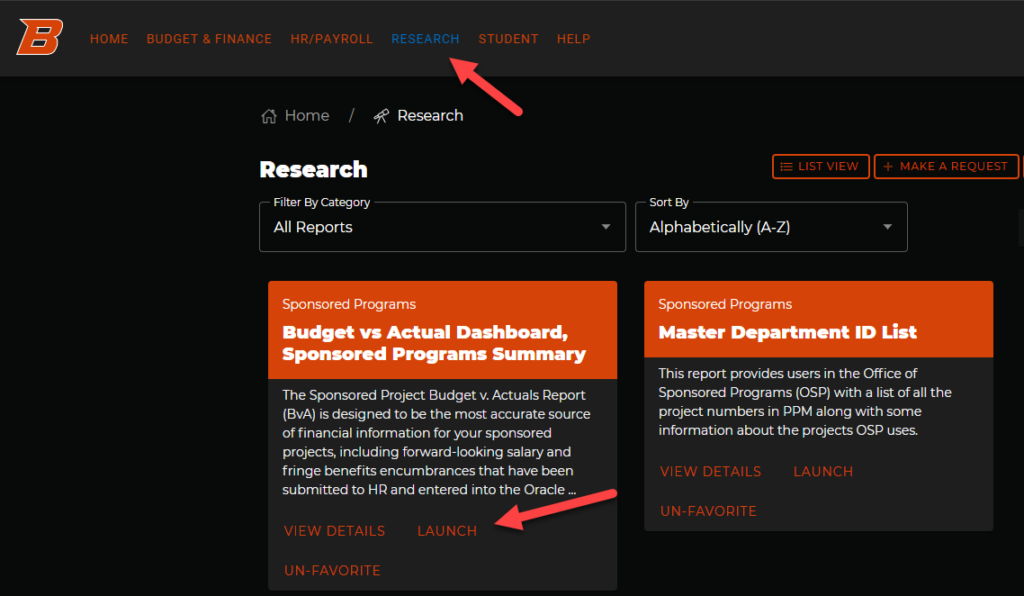

First, please clear your browser cache the first time. Second, visit Boise State Reporting on Bronco Hub* and navigate to:

- The “Research” tab in the menu bar;

- “Budget vs. Actual Dashboard, Sponsored Programs Summary”; and

- “Launch.”

*If you are located off-campus, you may need to be connected to the university’s VPN. A job aid is available here: Sponsored Programs BvA Dashboard Job Aid.

How do I update the BvA settings to display my preferred data by default?

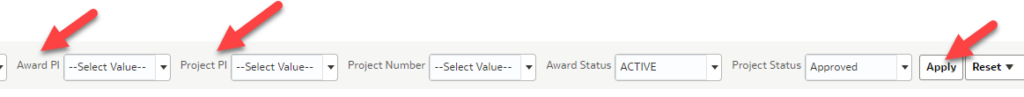

- To customize the BvA, use the dropdown menus at the top of the report to make your selections. Once you have completed your selections, make sure to select “Apply.” (Hint: If you want to see all projects where you are the Principal Investigator of the overall award, select your name from the “Award PI” dropdown box. If you want to see all projects where you’re responsible for the project budget, including as a Co-Principal Investigator, select your name from the “Project PI” dropdown box.)

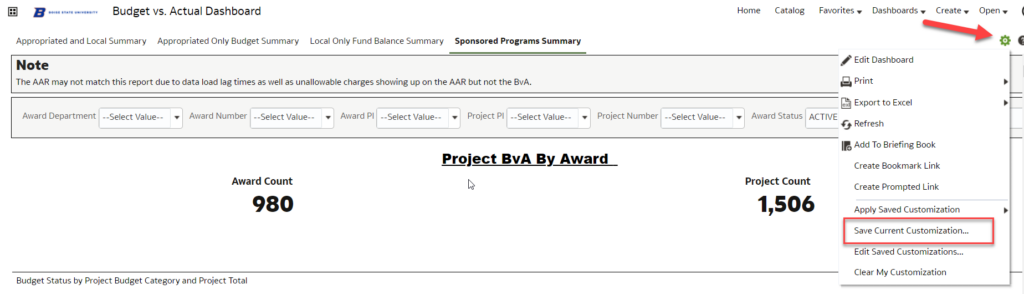

- To save your BvA customizations, select the “Page Options” gear icon in the upper, right-hand corner of the BvA, then select “Save Current Customization.”

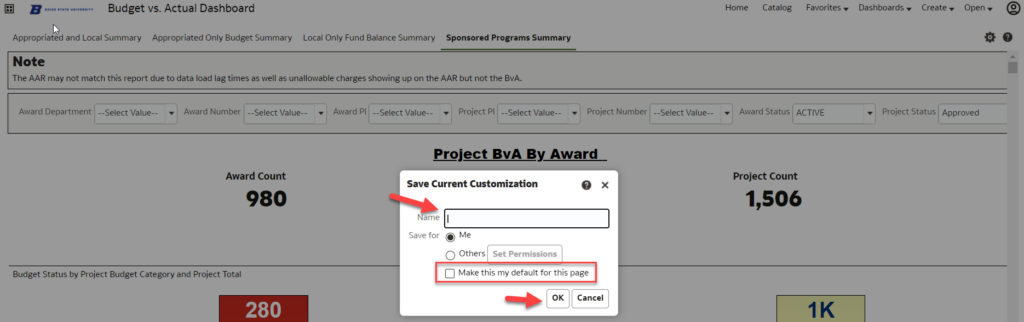

- In the popup window, type the name you want to give this customization. Then, make the customization your default by checking the box “Make this my default for this page” and clicking “OK.”

- Your selected customizations and associated data will load by default.

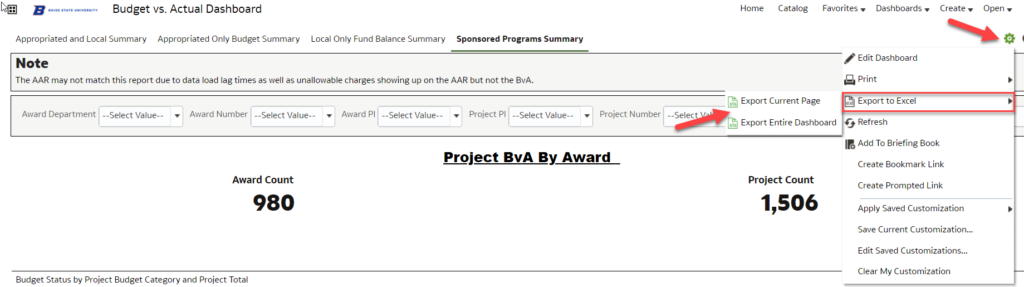

How do I export BvA data?

- You can export the current BvA page or the BvA output to Excel. Click the “Page Options” gear icon on the dashboard page and select “Export to Excel.”

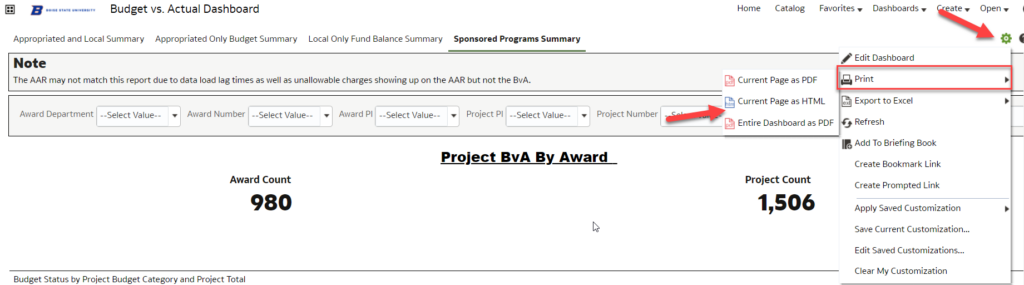

How do I print BvA data?

- You can convert the BvA to printable PDF or HTML files.

- To do so, click the “Page Options” gear icon on the BvA page and select “Print” followed by your desired option.

- You will then be able to print from Adobe’s or your web browser’s print functionality.

Does the BvA contain forward-looking salary and fringe benefits encumbrances?

Yes. Here are some important questions and answers about these data:

Q: Why were salary and fringe benefits commitments added to the BvA?

We included salary and fringe commitments in the BvA to make it easier for Principal Investigators to manage their sponsored projects. This change aims to minimize the reliance on shadow systems.

Q: Are the salary and fringe benefits commitment data provided in precise amounts?

The salary and fringe commitment information provided here is an estimate generated from the encumbrances submitted to HR. These encumbrances include forms like Employee Costing Change (ECC) and Individual Compensation Plan (ICP) which have been entered into HCM.

To calculate the data, the BvA follows a set of rules agreed upon by experienced stakeholders across campus. These rules prioritize different dates to determine the end date logic.

The prioritization is as follows:

- Employee Termination Date (i.e., the date when an individual’s employment with Boise State ends);

- Effort End Date (i.e., the date the employee’s effort is changed to another funding source on the ECC or the “Payroll End Date” on the ICP); and

The lesser of the following:

- Project End Date (i.e., the end date of the applicable PPM project); and

- Projected End Date (i.e., the projected work end date for temporary employees)

Q: How are salary commitments calculated?

- Regular Salary Commitments: (Institutional Base Salary / 26 Payroll Periods) * (Effort Percentage) = Per Pay Period Commitment

- ICP Salary Commitment: (ICP Amount / Number of Pay Periods Between the Current Date and the Payroll End Date Entered on the ICP) * (Effort Percentage) = Per Payroll Period Commitment

- Important Note for Both Regular Salary and ICP Salary Commitments: Even if the effort start and/or end dates do not correspond to exact payroll period start and end dates, the BvA still calculates entire payroll periods for forward-looking data. For example if the payroll period goes through 08-05-2023 but an employee’s effort ends on 07-26-2023, the entire payroll period ending on 08-05-2023 will be estimated.

Example for Regular Salary:

Project: 3000002817

Assignment Number: E111111111-1

Employee Type: Faculty

Effort Percentage: 27%

Hourly Rate: $29.34

Annualized Salary: $61,027.20

Termination Date: Null

Effort Start Date: 06-25-2023

Effort End Date 08-19-2023

Project Start Date: 04-26-2023

Project End Date: 10-27-2023

Assignment Projected End Date: Null

According to the dates priority in this example, the final decision date will be the Effort End Date of 08-19-2023. This means that the salary projections will include the current date to the payroll period end date of 08-19-2023. Using the provided formula, the committed regular salary calculation will be: ($61,027.20 / 26 Payroll Periods) * (0.27) = $633.75 for each pay period through 08-19-2023.

Example for ICP Salary:

Project: 3000001637

Assignment Number: Null (ICPs are not tied to assignments.)

Employee Type: Faculty

Payroll/ICP Start Date: 06-11-2023

Payroll/ICP End Date: 09-02-2023

Effort Percentage: 100%

ICP Amount: $1,038.00

Using the provided formula, the committed ICP salary calculation will be: ($1,038.00 / 6 Payroll Periods) * (1) = $173.00 for each payroll period from 06-11-2023 through 09-02-2023.

Q: How are fringe benefits commitments calculated?

- Regular Salary Fringe Benefits Commitments: (Regular Salary Per Payroll Period As Calculated * Variable Fringe Benefits Percentage) + ((Fixed Benefits Dollar Amount / 26 Payroll Periods) * (Effort Percentage))

- ICP Salary Fringe Benefits Commitments: (ICP Salary Per Payroll Period As Calculated * Variable Fringe Benefits Percentage) [Note: ICP fringe benefits do not include fixed benefits (e.g., insurance).]

- Important Note for Both Regular Salary and ICP Salary Fringe Benefits Commitments: Even if the effort start and/or end dates do not correspond to exact payroll period start and end dates, the BvA still calculates entire payroll periods for forward-looking data. For example if the payroll period goes through 08-05-2023 but an employee’s effort ends on 07-26-2023, the entire payroll period ending on 08-05-2023 will be estimated.

Example for Regular Salary Fringe Benefits (Using the Regular Salary Example):

Using the provided formula, the committed regular salary fringe benefits calculation will be: ($633.75 * 0.2052) + (($13,750 / 26 Payroll Periods) * (0.27)) = $272.83 for each payroll period from 06-25-2023 through 08-19-2023.

Example for ICP Salary Fringe Benefits (Using the ICP Salary Example):

Using the provided formula, the committed ICP salary fringe benefits calculation will be: ($173.00 * 0.2052) = $35.50 for each payroll period from 06-11-2023 through 09-02-2023.

Q: Why might I not see a salary and fringe commitment that I expect to see?

Some possible scenarios may include:

- The ECC or ICP has not been entered into HCM;

- The costing has ended based on one of the dates in the prioritization logic;

- There was an effort change submitted and/or the project number changed; and

- There was an error on the ECC or ICP, or an error entering the data into HCM.

Please speak with your departmental administrator or business manager about any questions or concerns you may have.

Q: Why do some Costing End Dates on salary and fringe benefits drilldowns show 12/31/4712?

This affects professional staff “regular” pay and new hires. When an ECC is effective on a particular date, but there is not another entry changing the funding to another source, the Costing End Date may be “12/31/4712.” We are evaluating this further because the end date logic discussed previously still applies.

Are p-card expenses immediately included in the BvA?

No, p-card expenses are not immediately represented in the BvA, AAR, or PPM. Instead, p-card expenses are processed at the end of the accounting month as internal payments. Campus users update the Bank of America “Works” application with coding information for their p-card expenses during the month, and the information is collected and added into internal payments to record the expenses shortly before the bills are paid.

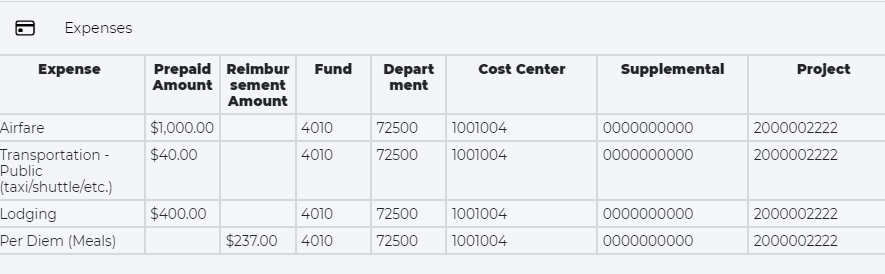

Are travel expenses included in the BvA?

Today, when a Travel Authorization (TA) is submitted, expenses marked as reimbursable to the employee will be encumbered, but expenses marked as prepaid by the university will not be encumbered.** Once the expense report has been approved and paid after the travel is complete, reimbursable costs and prepaid costs will show as actual expenditures. Importantly, the process for encumbering and unencumbering reimbursable expenses is currently performed through a manual process in University Financial Services (“UFS“), so adding and releasing encumbrances will not occur immediately in the BvA.

**Note: We are actively working with UFS to evaluate how to encumber both reimbursable and prepaid expenses in Oracle. Assuming this is possible, reimbursable and prepaid expenses will be encumbered in the BvA. We recognize how important encumbrances like this are for moving away from shadow systems, so more information is forthcoming. The goal is to change this FAQ to following in the not-too-distant future:

When a Travel Authorization (TA) is submitted, expenses marked as prepaid by the university and reimbursable to the employee will both be encumbered in the BvA. Once the expense report has been approved and paid after the travel is complete, prepaid and reimbursable costs will show as actual expenditures and the encumbrances will be removed. Importantly, the process for encumbering and unencumbering prepaid and reimbursable expenses is currently performed through a manual process in University Financial Services, so adding and releasing encumbrances will not occur immediately in the BvA.

Are there other expenses that may not immediately appear in the BvA?

There are various other expenses that may not be immediately charged to your sponsored projects and won’t be visible in the BvA, PPM, or AAR until other campus units initiate internal payments or all workflow approval is complete and an invoice is processed. Some examples include, but are not limited to:

- Tuition remission (discussions to address this are underway);

- Student stipend payments;

- Graduate student health insurance (discussions to address this are underway);

- Recharge center usage (discussions to address this are underway);

- OIT telecommunications (e.g., phones);

- On-campus housing;

- On-campus meeting/conference space;

- On-campus catering services;

- Transact campus deposits (e.g., online stores); and

- Cost transfers and other correcting entries.

To obviate the need for shadow systems, we will be making ongoing efforts to address the lack of encumbrances for each of the above.

What should I do if I notice incorrect costs charged to my sponsored projects?

If you identify incorrect and/or missing costs on your sponsored projects, please initially reach out to your departmental administrator or business manager for assistance.

What are the differences among the AAR, PPM’s Manage Awards, and the BvA?

General Notes

- The AAR is based on General Ledger data, but the BvA is based principally on PPM data.

- The BvA lives in the data warehouse and is updated once daily (i.e., it’s one day behind).

- The AAR and PPM contain mostly real-time data, but there are exceptions, such as p-card data and internal payments.

AAR and BvA Differences

- AAR and BvA actuals will not always match.

- As described in a different FAQ, the AAR may contain unallowable costs.

- AAR transactions occasionally fail to successfully import into PPM and have to be corrected to reflect appropriately in the BvA.

- The AAR does not have budgetary information, but the BvA does (i.e., originates in PPM).

- The AAR does not contain encumbrances, unless you run it specifically for encumbrances.

BvA and PPM Differences

- BvA and PPM actuals should match.

- BvA and PPM budgets should match.

- The BvA uses custom calculations for salary, fringe benefits, travel, and F&A encumbrances, and as discussed in a different FAQ, BvA encumbrances won’t always match PPM encumbrances.

Why should I use the BvA instead of the AAR?

The AAR is based on General Ledger data and does not contain encumbrances or project-specific controls (e.g., start date, end date, budgets, disallowed costs), so the AAR is not a good tool for projecting future expenditures and may contain unallowable costs. The BvA, however, is based on PPM data and includes future-looking HCM data, so it incorporates project-specific controls and is a useful projection tool.

Why should I use the BvA instead of PPM’s Manage Awards?

While PPM’s Manage Awards data reflect project-specific controls, it does not accurately reflect certain encumbrances (e.g., travel encumbrances are represented as actual expenditures in PPM instead of encumbrances). Additionally, PPM’s Manage Awards data do not include forward-looking salary and fringe benefits encumbrances.

To whom should I direct technical questions about the BvA?

Technical questions or concerns about the BvA should be directed to Research Administration Systems & Analytics (RASA) in the Division of Research and Economic Development. They are available at rasa@boisestate.edu.