FAQs and Additional Information

Form 1098-T

Colleges and universities are required by U.S. law each year to provide each student who is a “US person” for tax purposes with Form 1098-T, to assist the students and their families in computing any tax credit or deduction they may be able to claim, based on amounts they have spent for education.

Most foreign students do not need Form 1098-T for any purpose

When will I receive my 2024 Form?

The form will be mailed no later than Jan. 31, 2025. If you have signed up for the electronic option on your Student Center on myBoiseState, it will be available on or before Jan. 20, 2025.

Contact information

Student Financial Services, bsu1098t@boisestate.edu , (208) 426-1212.

Form 1099

2024 Forms 1099-MISC and 1099-NEC

The IRS requires all payments made to suppliers be reported as income on their year-end taxes. Boise State University is required to generate a 1099 tax form once the cumulative payments made to suppliers reach a threshold of $10 for royalties, or $600 threshold for all other payments. Physical copies of these forms are mailed to suppliers and submitted to the IRS by the year-end deadline of January 31 each year.

What is a Form 1099-MISC?

A 1099-MISC tax form reports “other” income payments such as rents, prizes and awards, medical services and participant fees.

What is the 1099-NEC?

A 1099 Non-Employee Compensation form reports service payments made to non-employees of Boise State such as consultants, speakers, and other independent contractors.

When will I receive my 2024 1099 Form?

Physical copies of both forms 1099-MISC and 1099-NEC will be mailed by Jan. 31, 2025.

For questions regarding 1099 forms please contact Payables, P2P_ICClassification@boisestate.edu or (208) 426-3434.

Form W-2

A form by which employers provide a statement of income and taxes withheld to the employee and to the Internal Revenue Service each year.

When will I receive my 2024 Form?

The form will be mailed or made available to you electronically no later than Jan. 31, 2025.

To Access and View your W-2

Learn how to access and receive your W-2 electronically on the Human Resources website.

Contact information

payroll@boisestate.edu, (208) 426-4440

Form 1042-S

Form 1042-S Foreign Person’s U.S. Source Income Subject to Withholding

What is a Form 1042-S?

Form 1042-S reports taxable income for international persons who have received the following types of income:

- Wage payments made to employees who have claimed tax treaty benefits.

- Fellowship/Scholarship income that is reportable. This includes all income not applied directly to the tuition and fees.

- Independent personal services for work performed in the U.S.

- Royalty payments issued to individuals or entities.

- Non-employee Prize or Award payments

- Amounts subject to reporting under FATCA (entities only)

How is Form 1042-S distributed?

Form 1042-S is generated through the Sprintax Calculus online tax reporting system. Forms issued to individuals are distributed directly through Sprintax Calculus, unless the individual has opted to receive their form by mail. Forms 1042-S issued to Foreign Entities, are issued through the mail.

When will I receive my 2024 Form?

Electronic and mailed forms will be distributed no later than March 15, 2025.

Electronic forms are usually available by mid-February.

Contact information

Tax Reporting taxreporting@boisestate.edu

Tax Assistance Sessions for 2024

Tax reporting and ISS are offering in person tax assistance sessions and please see the schedule below. Idaho State tax Commission is conducting virtual sessions for assisting in preparation of tax returns. If you would like to sign up for any of these sessions, please email taxreporting@boisestate.edu.

In person assistance schedule:

Monday, March 3

- 9:30 a.m. – 11 a.m.

- 1:30 p.m. – 3 p.m.

- 5 p.m. – 6:30 p.m.

Thursday, March 6

- 8:30 a.m. – 9:30 a.m.

- 11:30 a.m. – 1 p.m.

- 3:30 p.m. – 5 p.m.

Friday, March 7

- 9:30 a.m. – 11 a.m.

- 3:30 p.m. – 5 p.m.

Idaho State Tax Commission virtual sessions schedule:

Wednesday, March 12

- 1:30 p.m. – 4 p.m.

- 4:30 p.m. – 7 p.m.

Thursday, March 13

- 2 p.m. – 4:30 p.m.

- 5 p.m. – 7:30 p.m.

More information on tax returns

Who must file tax forms for 2024 tax season?

Even if you did not earn any income, if you were physically in the US on F or J status anytime between Jan. 1 to Dec. 31, 2024, you’re obligated to file a Form 8843 with the IRS (the Internal Revenue Service, or ‘IRS’, are the US tax authorities).

Meanwhile, if you earned more than $0 of taxable US source income, you may need to file a federal tax return with the IRS. Depending on your individual circumstances, you may also need to file a state tax return(s).

Tax Filing Deadline

April 15, 2025 is the last day for residents and nonresidents who earned US income to file Federal tax returns for the 2024 tax year.

Who is considered Resident or Nonresident for Federal Tax Purposes

Generally, most international students and scholars who are on F, J, M or Q visas are considered nonresidents for tax purposes. International undergraduate students on J-1 and F-1 visas are automatically considered nonresident for their first five calendar years in the US, while Scholars/Researchers on J visas are automatically considered nonresidents for two out of the last six calendar years in the US. If you’ve been in the US for longer than the five or two year periods, the Substantial Presence Test will determine your tax residency.

How to File

Boise State has teamed up with Sprintax to provide you with an easy-to-use tax preparation software designed for nonresident students and scholars in the US. Boise State University staff are not qualified or allowed to provide individual tax advice.

After you login to Sprintax, you will be asked a series of questions about the time you have spent in the US over recent years. Sprintax will then determine your tax status. If it determines that you are a “nonresident alien” (NRA) for federal tax purposes, you can continue to use the software to respond to a series of guided questions. Sprintax will then complete and generate the tax forms you need to send to the tax authorities.

However, if Sprintax determines that you are a resident alien for federal tax purposes, you won’t be able to continue using the software.

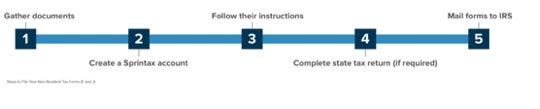

Step by Step guide on How to File Your Nonresident Tax Forms (F and J)

1) Gather the documents you may need for Sprintax

2) Create a Sprintax Account:

You will receive an email from Tax Reporting providing you with a link to Sprintax to set up your account as well as your unique code to use on Sprintax. This unique code will cover the costs of the federal tax return and 8843 at no cost to you. Open your new Sprintax account by creating a UserID and password or if you have an existing account on Sprintax you can login using your existing credentials.

3) Follow the Sprintax instructions

If you did not earn any US Income: Sprintax will generate a completed Form 8843 for you and each of your dependents (if you have any).

If you did earn US Income: Sprintax will generate your “tax return documents”, including form 1040NR, depending on your circumstances.

4) (With U.S. income only) If required, complete your state tax return

You will receive an email from Tax Reporting providing you with a link to Sprintax to set up your account. Boise State is offering discounts to cover the costs of filing the federal tax return and Form 8843 at no cost to you for the first 100 users. Open your new Sprintax account by creating a User ID and password or if you have an existing account on Sprintax you can login using your existing credentials.

5) Read the instructions for filing/mailing your returns

Remember to read the instructions that Sprintax provides.

You will be required to download, print and sign your federal tax return and mail it to the IRS. If you have a state filing requirement, you must also mail this to the tax authorities.

Finally, if you only need to file Form 8843, this will also need to be mailed to the IRS.

Sprintax Educational Tax Videos and Blog

You also have access to the Sprintax YouTube account where there are a number of educational videos on nonresident taxes. These will provide further clarity on nonresident tax and how to use Sprintax. Sprintax also offers a range of useful content on their blog to help you file your return.

DISCLAIMER: Boise State staff are NOT permitted to assist any student/scholar with any IRS tax form preparation or tax related questions. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.

Sprintax Support

If you need help while using Sprintax, you can contact their support team using the following options

Email – hello@sprintax.com

24/7 Live Chat Help

Refer to their FAQs

1095-C Statement of Employer-Provided Health Insurance Offer and Coverage

The Form 1095-C and 1095-B contain important information about the healthcare coverage offered or provided to you by your employer. Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit. Think of the form as your “proof of insurance” for the IRS.

You will receive a Form 1095-C from Boise State University if you worked an average of 30 hours or more per week over the year. The information on the form reflects the coverage offered to the employee.

You will receive a Form 1095-B from Blue Cross of Idaho or Pacific Source if you were enrolled in healthcare coverage through Boise State University, this form reflects the coverage for you and your dependents.

Employees may receive their Form 1095-C from Boise State University electronically through a secured web portal. If you do not consent to receive electronically, a paper 1095-C form will be mailed to the employees’ home no later than Jan. 31, 2025.

For questions and answers about Health Care Information Forms and filing your income tax return, visit the IRS’ website.

To learn more about accessing and receiving your 1095-C electronically, visit HR’s website.

For more information and how to read your 1095, visit the My Tax Form homepage and the Form 1095-C Decoder.

VITA Program

The Department of Accountancy offers tax assistance through the IRS VITA program. Learn more on the Department of Accountancy’s website.

Sprintax Tax Prep Tutorial Videos

Having trouble accessing your information?

- You may need to reset your password. For instructions, visit the Office of Information Technology’s website.

- For other questions regarding access to myBoiseState, call the Office of Information Technology Help Desk at (208) 426-4357 (HELP).