Understanding My Bronco Hub Payslip

Disclaimer – Bronco Hub Job aids are currently transitioning to accessible WordPress pages. All current job aids are still available through Jobs Aids and Resources.

Who is this job aid for?

This job aid is for employees who need to review and understand information on their payslip.

Bronco Hub Payslip Sections and Infographic

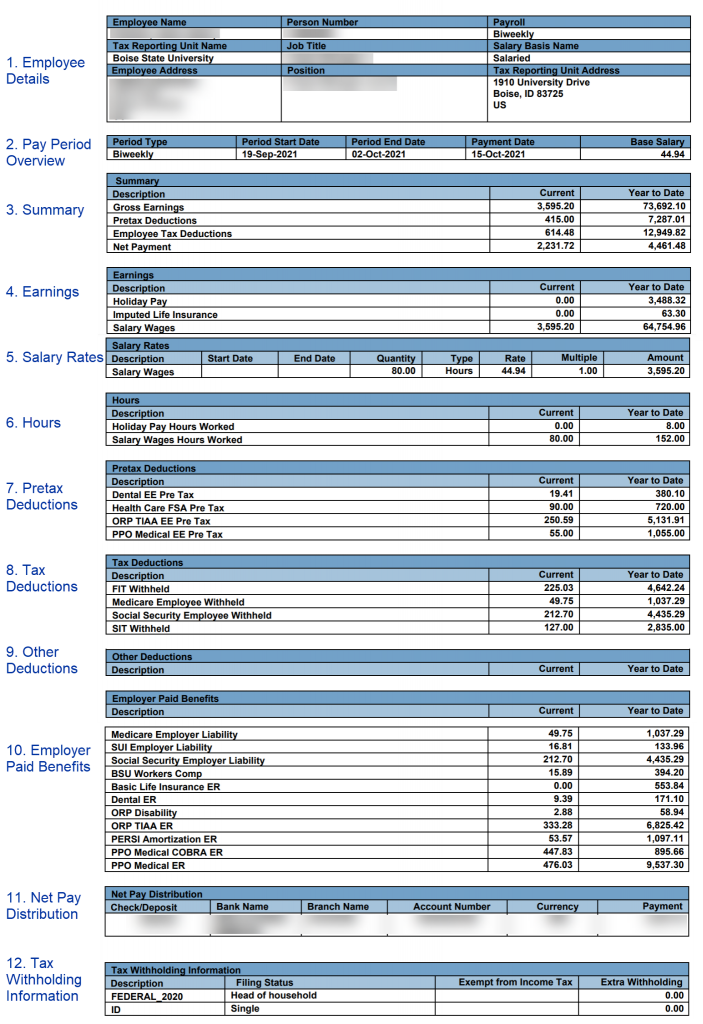

There are 12 sections on the Bronco Hub payslip. Text descriptions of each section are provided in the Section Descriptions portion of this page. You can also review the payslip infographic for a visual overview of the Bronco Hub payslip.

Section Descriptions

1. Employee Details

Provides Employee Name, Person Number (employee ID), Employee Address, Job Title, Position, Salary Basis (hourly or salary).

2. Pay Period Overview

Provides information about the pay period start and end date along with base hourly rate.

3. Summary

Provides a summary of current pay period and year to date totals for the following:

- Gross Earnings: Income earned before taxes or other applicable adjustments (sum of section 4 of pay slip). The gross earnings section includes imputed income.

- Imputed Earnings: (Not all employees will see this. Benefit eligible employees.) The value of fringe benefits provided to employees that is used to calculate the total taxable income of the employee.

Examples include: Basic or group life insurance for salary greater than $50,000. Educational assistance exceeding IRS limits. Personal use of company car. Tuition waiver - Pre-Tax Deductions: Deductions taken from gross earnings before taxes are withheld (section 7 of pay slip – e.g. health insurance deductions).

- Employee Tax Deductions: Total tax deduction amounts for current pay period and year to date. Tax Deductions (section 8 of pay slip) lists the individual items that make up the totals listed in the Summary section.

- Involuntary Deductions: These are deductions that are legally mandated on the employee (e.g. wage garnishment).

- Voluntary Deduction: Other deductions (section 9 of the pay slip)

- Net Payment: Net (take home) pay, which is the Gross Earnings minus Imputed Earnings, Pretax Deductions, Employee Tax Deductions and Voluntary Deductions.

4. Earnings

Provides a detail of what makes up the employee’s Gross Earnings Earnings prior to 10/1/21 will not display in HCM. To view earnings prior to 10/1/21, follow these instructions to view final payslip in PeopleSoft HR. View this resource for a list of all potential earning types.

5. Salary Rates

Provides an overview of wages; hours multiplied by hourly rate, includes any premium amounts such as overtime earned within the current pay period.

6. Hours

Provides information about the current pay period and year to date number of hours allocated.

7. Pre-Tax Deductions

Provides current pay period and year to date amounts for pre-tax deductions listed. Pre-tax deductions reduce your overall taxable income amount.

Examples include:

- Health

- Dental insurance

- Parking

For more information, check out the Medical, Prescription, Dental and Vision and the Retirement webpages.

8. Tax Deductions

Provides current pay period and year to date amounts for tax deductions listed. Categories include:

- FIT = Federal Income Tax

- Medicare

- Social Security

- SIT = State Income Tax

9. Other Deductions

Items listed in this section are after tax deductions.

10. Employer Paid Benefits

Provides current pay period and year to date amounts for employer contributions for items listed. Note about PERSI Amortization: PERSI Amortization is an employer charge so faculty and professional staff can enroll in the Optional Retirement Plan sponsored by the State Board of Education and are not eligible to enroll in the Public Employee Retirement System of Idaho (PERSI).

11. Net Pay Distribution

Provides direct deposit information for the specific pay period dates noted on the pay slip.

12. Tax Withholding Information

Provides your employee filing status. To view your W-4, follow these instructions.